can you get a tax refund from unemployment

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

How To Get A Refund For Taxes On Unemployment Benefits Solid State

The unemployment tax refund is only for those filing individually.

. The tax agency has confirmed it is sending. Unemployment benefits are taxable income so recipients must file a Federal tax return and pay taxes on those benefits. Again the answer here is yes getting unemployment will affect your tax return.

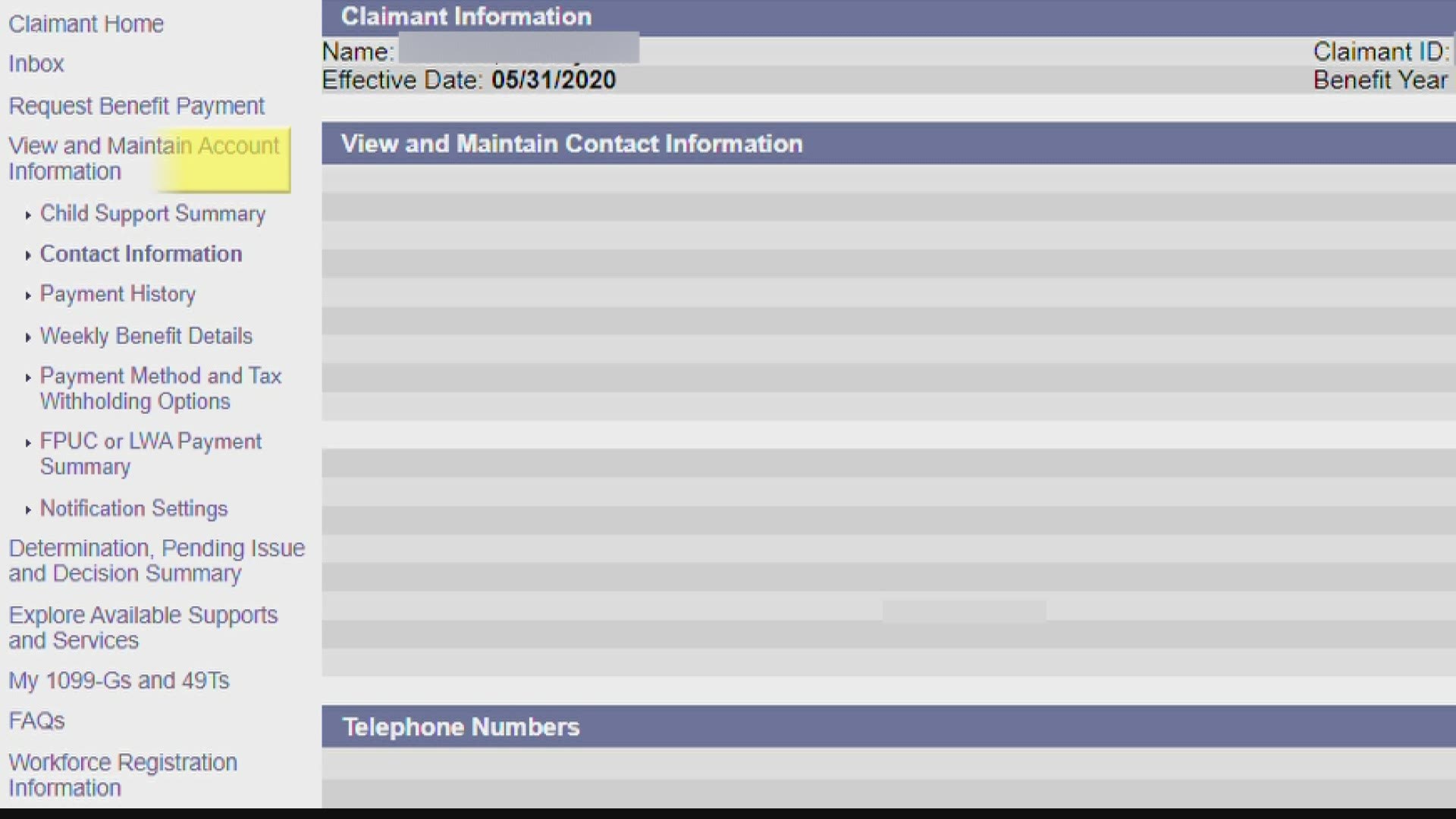

If you filed taxes earlier this year and paid on unemployment benefits you received in 2020 then you might be owed a refund by the IRS. If you havent filed your tax returns yet you will deduct the 10200 from your additional income on line 8 on Schedule 1 of your federal tax return. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. More than 7million households who received unemployment checks last year may be able to get a refund worth up to 10200 Credit. The IRS will issue refunds in two phases.

It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. Usually unemployment benefits are taxable but the act waived the tax due to the impact of the COVID-19 pandemic. The first refunds are set to be handed.

Can you get a tax refund from unemployment. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their.

If you were quick on the draw and paid your taxes early on any federal unemployment benefits from last year you could be receiving a refund as soon as this week. If you have had your final pay from your employer and are not getting taxable benefits a pension from your employer and have not started a new job you can apply for tax refund. The IRS announced a couple weeks ago that millions of Americans who were on unemployment in 2020 would be receiving refunds on their 2020 taxes thanks to the.

Updated June 1 2021. Depending on your overpayment the department can take actions to recover the amount due including taking your future UC benefits intercepting your federal income tax refund filing a. Chances are youve already paid your income taxes for 2020.

As most people eligible for the break filed their tax returns. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. Some taxpayers who had.

People might get a refund if they filed their returns. If youve paid too much during the year youll. The federal tax code counts jobless benefits as taxable income.

Updated January 07 2019. Will I still get a tax return if I was on unemployment. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

You can have income tax withheld from your unemployment benefits too but you should be aware that withholding taxes from unemployment benefits is not automatic. But what this exclusion means is if you paid taxes on unemployment insurance benefits that you received in 2020 you can get a. Most people do not have to take any action or file an amended return to get a refund if they overpaid on unemployment compensation according to the IRS.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Irs Unemployment Refunds Moneyunder30

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

When Will Irs Send Unemployment Tax Refunds 11alive Com

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

Unemployment Benefits In Ohio How To Get The Tax Break

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Here S Why Another Tax Break On Unemployment Benefits Is Unlikely

Questions About The Unemployment Tax Refund R Irs

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Dor Unemployment Compensation State Taxes

What You Should Know About Unemployment Tax Refund

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals