owner's draw vs salary uk

However many company founders take no salary in the first years of running a business while others take so much that. Not exactly a fortune but if it was.

Thats a very common question were asked and like most tax questions the answer is not cut and dried.

. As a company owner should you pay yourself a salary or drawings. A draw is usually smaller than the commission potential and any excess commission over the draw payback is extra income to the employee with no limits on higher earning potential. Over the year the optimum salary in a company with two or more directors is 11908.

Salaries paid are tax deductible for your company reducing its profits and taxable income and therefore the amount of company tax it pays. Salary is direct compensation while a draw is a loan to be repaid out of future earnings. A partners distribution or distributive share on the other hand must be recorded using Schedule K-1 as noted above and it shows up on the owners tax return.

Salary is fixed and higher earning potential comes only. Understand the difference between salary vs. She would also have to pay 3596 in NICs.

So 12570 is the most tax-efficient directors salary for the 202223 tax year if you can claim the EA the company is better off by 65930 although the director must pay 8791. As we outline some of the details below. Also by taking a 12570 salary the company saves 65930 in additional Corporation Tax compared to the 9100 salary level per employee.

Nil tax up to personal allowance of 12500 used 8784 for salary and 3716 for dividends No tax on dividends of 2000 due to the dividend allowance. If the business is a limited company salary arrangements are more formal because directors will have to pay tax Pay As You Earn or PAYE and NIC on their salaries. This 24100 is taxed at the dividend basic rate of income tax which is just 75 per cent.

So Janes income tax bill for the year will be 1807. Small business owners should learn about the circumstances under which they could pay themselves with an. If Jane had taken the whole 38600 as salary then her income tax bill would have been 20 per cent of 26100 which is 5220.

All business owners ask whether they should pay themselves a salary or drawings. In 202223 the primary threshold will increase mid-year. Total income is 3000000.

If the company has already paid tax and franking credits on the dividend are. Take salary at the NI Primary threshold of 12570 for the full tax year. Its a way for them to pay themselves instead of taking a salary.

Owners equity is made up of a variety of funds including money youve invested in your company. If he earns less than the draw amount he does not keep any commission. 75 on dividend income within the basic rate band.

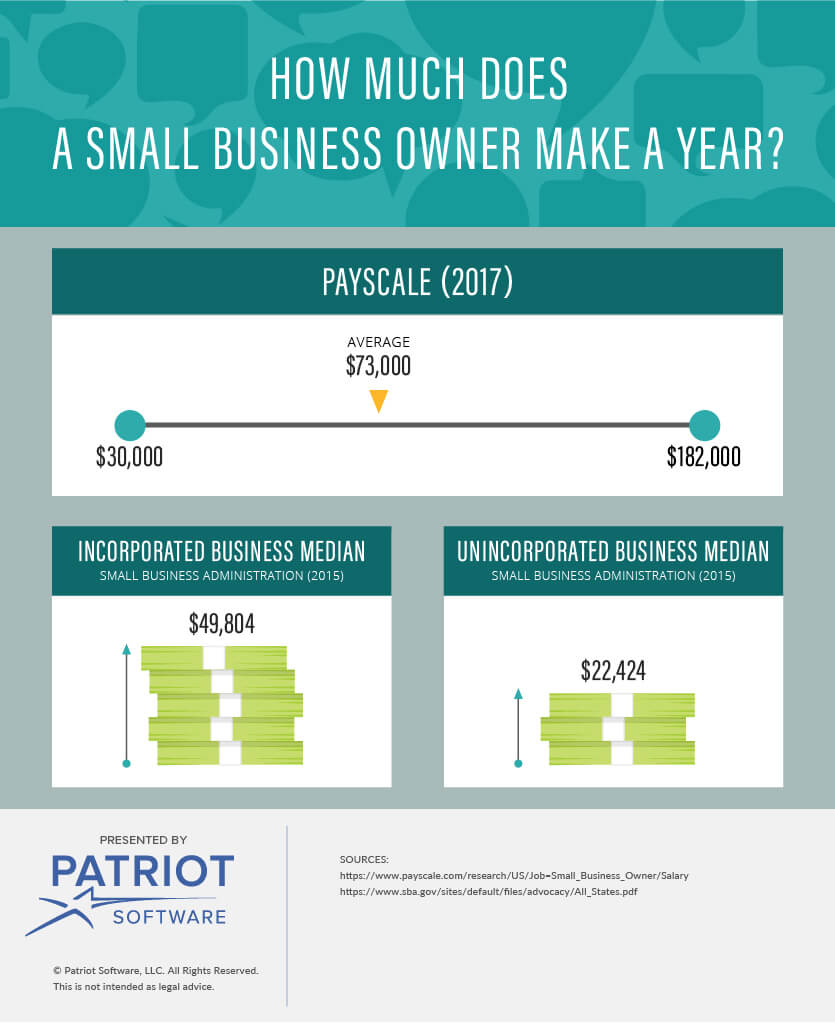

Small business owners make on average 70300. A sole proprietor or single-member LLC owner can draw money out of the business. After the employees sales figures for the month are calculated the employee may keep any amount of commission he earns that exceeds the draw amount.

A draw is an amount of money the employee receives for a given month before his monthly sales figures are calculated. Heres a high-level look at the difference between a salary and an owners draw or simply a draw. The reason for this is because a salary attracts a National Insurance levy.

325 on dividend income within the higher rate band. According to Payscale US. Take salary at the NI Secondary threshold for 3 months 2275 then switch to NI Primary threshold for 9 months 942750 making a total salary of 1170250.

64 09 358 5656. The most efficient salary for 2 or more directors in 2022. What Is An Owners Draw.

Crunch recommends you consider the most tax efficient outcome for your limited company and the director. There are pros and cons to both and we examine the issues. The National Insurance rate for employees is 12 between 8632 and 50024 and 2 above this figure.

It is an accounting transaction and it doesnt show up on the owners tax return. This means that the point at which you start paying employees NI will be 9880 until July 2022 when the threshold increases to 12570. Single-member LLC owners are considered to be sole proprietors for tax purposes so they take a draw like a sole proprietor.

At this level of dividends you will have basic rate tax to pay of 2663 calculated as follows. Dividends paid by a company to a shareholder out of after-tax profits are taxable for that shareholder. The company has to pay 128 per cent employers NIC on gross salaries.

Directors of owner-managed companies often draw low levels of salary typically between 7500 and 9500 per annum. This is called a draw. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use.

That means that an owner can take a draw from the business up to the amount of the owners investment in the business. Owners equity is made up of any funds that have been invested in the business the individuals share of any profit as well as any deductions that have been made out of the account. Salary versus Dividends shows company owners how to save thousands each year by choosing the best mix of salary dividends rental income pension contributions etc.

The business owner takes funds out of the business for personal use. The PAYE and NIC will be remitted to HMRC monthly. Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use.

Understand the difference between salary vs. 35500 41216 less 3716 less 2000 dividends taxable at 75 - 2663. Salary versus Dividends UK Guide.

Before you can decide which method is best for you you need to understand the basics. Salary and Bonuses. Youll pay tax on dividends you receive over 2000 - the tax-free Dividend Tax Allowance at the following rates.

Care is required to minimise tax liabilities because for. The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account.

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

Business Operations Archives Leadership Girl Business Owner Business Operations Management

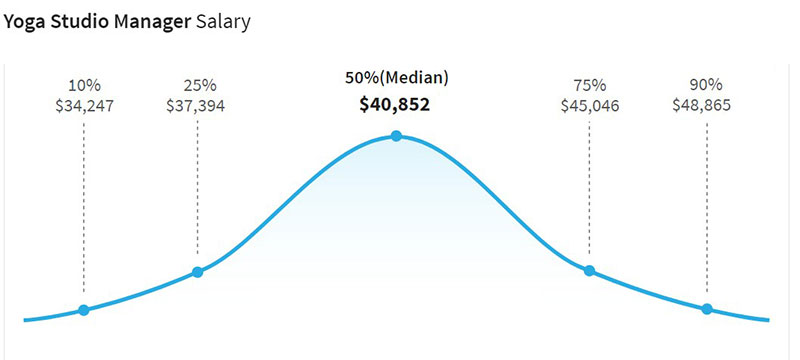

Yoga Studio Owner Salary How Much Can You Make

How To Pay Yourself As A Small Business Owner Salary Vs Draw Start Your Business Youtube

Calculating Ebitda How Profitable Is Your Business Doeren Mayhew

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Franchising 101 Understanding The Ins And Outs Of A Franchise Owner Salary

Electronics Design Engineer Salary And Income Report In Uk By Salaryhood 2019 2020 Assistant Jobs Salary Income Reports

Salary Vs Owner S Draw How To Pay Yourself As A Business Owner 2021 Salary Business Owner Business

Indiafilings Indiafilings Twitter Employment Tax Rate Business Owner

Do You Know It S Important For You To Decide How To Pay Yourself As A Business Owner These Ti Personal Financial Statement Business Owner Small Business Owner

How To Pay Yourself As A Business Owner Xero Sg

How Should Your Business Owner Salary Be Paid Dsl

How Much Do Small Business Owners Make Surprising Averages

Explore Our Example Of Pay Stub Template For Truck Driver For Free Payroll Template Statement Template Business Template

Uk Sales Survey Statistics Infographic Infographic Sales Recruitment Development

How To Pay Yourself As A Small Business Owner Gusto

Counter Offer Letter And How To Make A Good One Salary Negotiation Letter Professional Reference Letter Job Letter